- Platform

-

Company

-

About Brim Financial

Meet the first fintech in Canada licensed to issue credit cards.

-

Testimonials

Discover the real stories behind our success – where happy customers turn their experiences into heartfelt testimonials.

-

In The News

Explore what we’re up to from news features, blogs, and beyond.

-

Careers

Forge Your Future: Join our team and shape the next chapter in your career journey.

Our Company

-

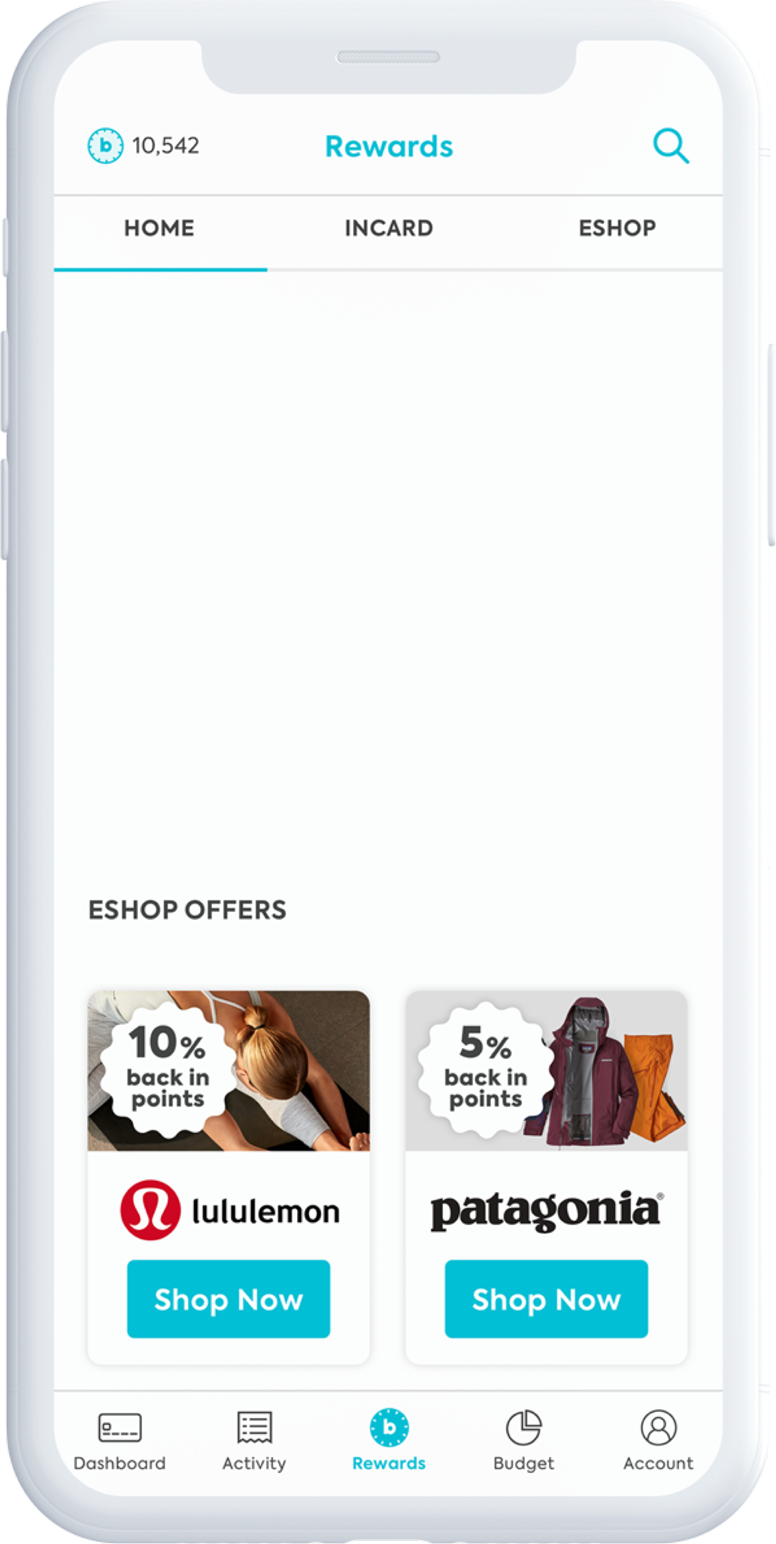

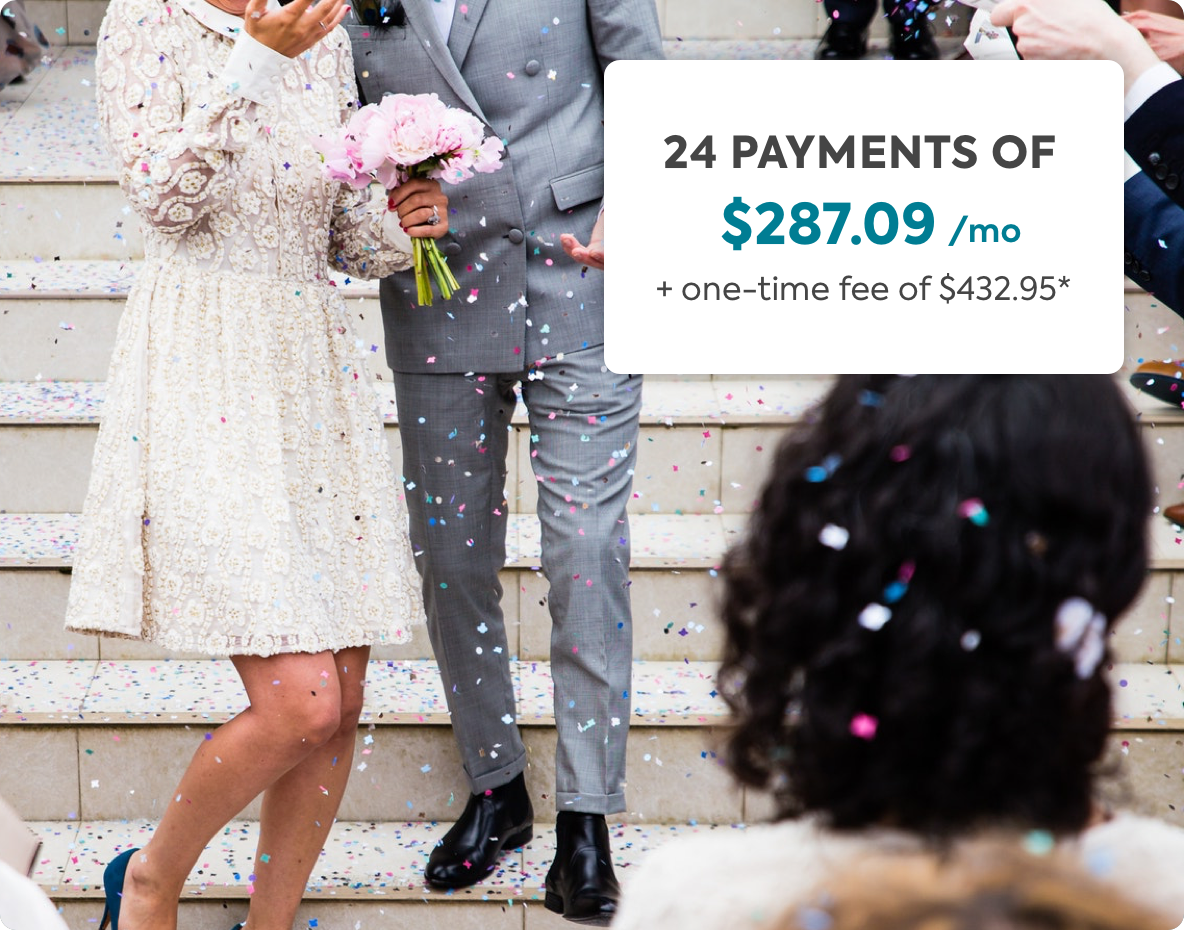

- Credit Cards

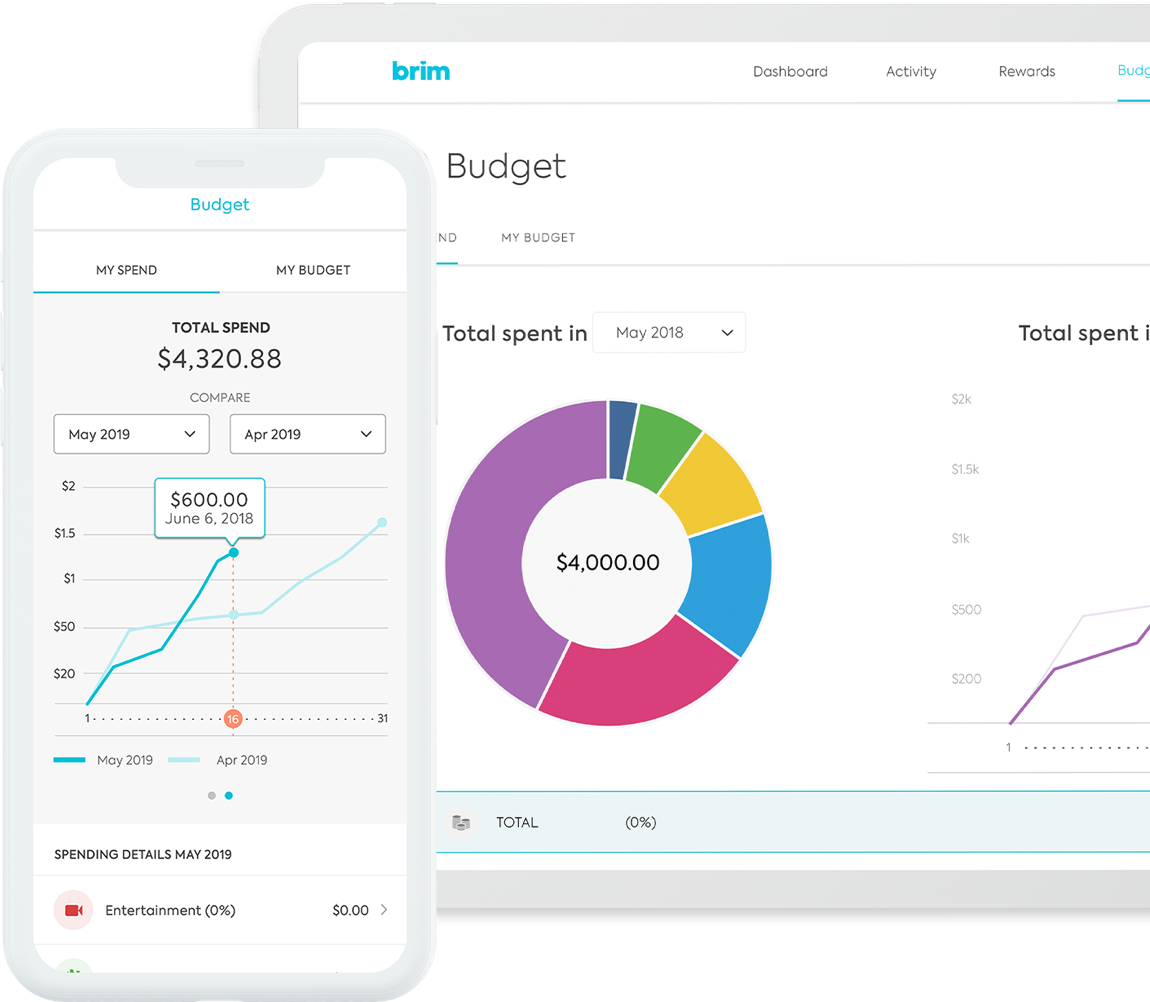

- Our Platform

-

Company

-

About Brim Financial

Meet the first fintech in Canada licensed to issue credit cards.

-

Testimonials

Discover the real stories behind our success – where happy customers turn their experiences into heartfelt testimonials.

-

In The News

Explore what we’re up to from news features, blogs, and beyond.

-

Careers

Forge Your Future: Join our team and shape the next chapter in your career journey.

-

- Credit Cards