-

Platform

-

Business & Commercial Platforms & Capabilities

Transform and modernize your digital business banking platforms.

-

Consumer Digital Platforms & Capabilities

Create your modern consumer digital platforms.

-

Enterprise Workflow Platforms & Capabilities

Enable you to operate your end to end ecosystem.

Our Platforms

-

-

Company

-

In The News

Explore what we’re up to from news features, blogs, and beyond.

-

Insights And Reports

-

Careers

Forge Your Future: Join our team and shape the next chapter in your career journey.

-

Testimonials

Discover the real stories behind our success – where happy customers turn their experiences into heartfelt testimonials.

-

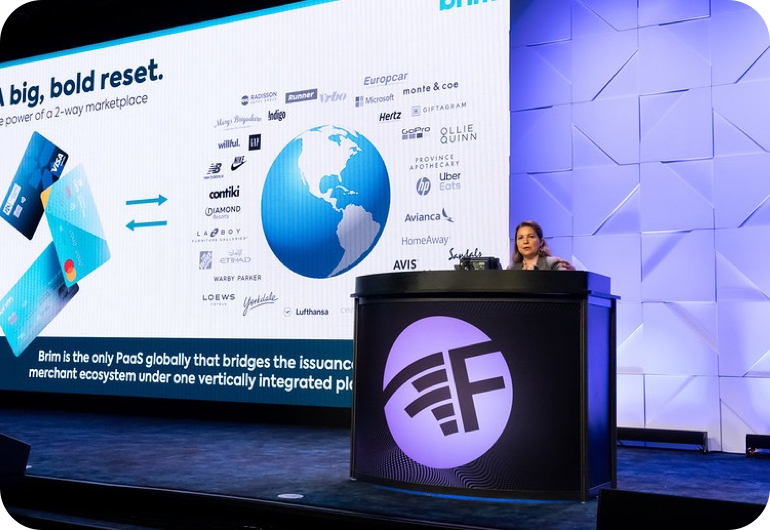

About Brim Financial

Brim is a licensed and certified card issuer in North America.

Our Company

-

-

Solutions

-

Solutions

Case-Studies

-

Insights And Reports

-

- Our Platform

-

Company

-

In The News

Explore what we’re up to from news features, blogs, and beyond.

-

Insights And Reports

-

Careers

Forge Your Future: Join our team and shape the next chapter in your career journey.

-

Testimonials

Discover the real stories behind our success – where happy customers turn their experiences into heartfelt testimonials.

-

About Brim Financial

Brim is a licensed and certified card issuer in North America.

-

- Solutions